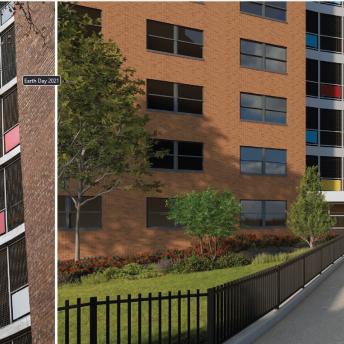

Brooklyn, NY - The New York City Housing Development Corporation (HDC) and the Department of Housing Preservation and Development (HPD) joined Trinity Financial, New York City Housing Authority, elected officials, and project partners today to celebrate the start of construction on a new 12-story affordable housing development in the Brownsville neighborhood of Brooklyn. Van Dyke III will bring 180 affordable housing units to NYCHA’s Van Dyke Houses campus.

“Today we celebrate the addition of 100% affordable housing to the Van Dyke Houses community,” said Deputy Mayor Vicki Been. “This new building will provide homes for 180 households, in addition to providing a child-care center and a community health clinic for current NYCHA residents and the surrounding Brownsville neighborhood. Van Dyke III illustrates the importance of public-private partnerships in making New York City a home for all.”

“Our strength is in our partnerships and collaborations. I am pleased to work with our colleagues in NYCHA and HDC to create 180 new affordable homes on this NYCHA Van Dyke campus,” said HPD Commissioner Louise Carroll. “Under the leadership of Deputy Mayor Been, we will leave no stone unturned in our search for ways to build a more affordable New York City together. I would like to thank our development team led by Trinity Financial and all of our other partners for making this development possible. Thank you and congratulations.”

“This development will bring 180 new affordable homes to NYCHA’s Van Dyke campus - nearly a third of which will serve formerly homeless individuals and families,” said HDC President Eric Enderlin. “Thanks to our partners and elected officials for their many contributions to this project and their ongoing dedication to providing greater opportunity to the Brownsville community.”

“Trinity is proud to play our part in this important redevelopment effort. Working so closely with NYCHA and the residents of the Van Dyke Houses to come up with creative ways to produce much needed affordable housing and community services and amenities is especially rewarding," stated Kenan Bigby, Managing Director of Trinity Financial. "We are deeply thankful for the hard work exhibited by the development team and our funding partners, including HDC and HPD.”

“This new affordable housing development is an example of how the State’s Brownfield Cleanup Program can lead to amazing things in New York,” said New York State Department of Environmental Conservation (DEC) Commissioner Basil Seggos. “These cleanups are helping to provide safe and affordable places to live in city neighborhoods and putting formerly blighted sites to good use and benefitting the community as a whole.”

“NYCHA is proud to be a partner in providing this essential 100 percent affordable housing to New Yorkers. We must use every tool at our disposal, including underused property, to benefit low income families,” said NYCHA Chair and CEO Greg Russ. “Today’s milestone is the result of a productive and remarkable planning process, which included the voices of hundreds of residents and community advocates and demonstrates what can be achieved when we work together to address our City’s challenges.”

Van Dyke III will include 180 apartments; 56 studios, 52 one-bedrooms, 43 two-bedrooms, and 28 three-bedrooms and will serve extremely low- and low-income households, with 54 units reserved for formerly homeless households receiving assistance through the NYC 15/15 Supportive Housing Initiative. CAMBA, a highly acknowledged 42-year-old nonprofit organization, will be providing support services for these formerly homeless individuals.

Building amenities will include a computer lab, a fitness room, a tenant lounge, a community room, an accessible roof deck, a package delivery room, and a ground floor outdoor recreational area. The site will also contain two cellar and ground floor community spaces, anticipated to be the home of a daycare center operated by the Friends of Crown Heights and a community health clinic operated by the Brownsville Multi-Service Family Health Center.

"One out of five children and families in Brownsville are living in shelters. I am pleased that the Van Dyke III development will provide homes for some of these families so that they can live in a decent, clean and safe environment to grow and live productive lives," noted Lisa Kenner, President of the Van Dyke I Resident's Association.

“Community Board 16 is appreciative of the Van Dyke III project because it serves as an example to residents that their requests were heard and can be delivered to the community,” said Genese T. Morgan, Chairperson of Brooklyn Community Board #16. “This project is addressing the top three priorities of our Statement of District Needs by creating access to affordable housing, health and wellness services and youth education and after-school services during the most impressionable years.”

“We are proud to work collaboratively with the Van Dyke III development team to create a compelling lending package that allowed for deep affordability for many of the units and supportive services for formerly homeless residents,” said Citi Community Capital Director Tricia Yarger.

“Providing a safe affordable place to live and caring for our youth and vulnerable populations are some of the most important responsibilities of every community,” said Margaret Anadu, Managing Director and Head of the Goldman Sachs Urban Investment Group. “We are proud to partner with the Trinity Financial to invest in the development of Van Dyke III which helps strengthen the Brownsville neighborhood and advance the goals set by the NextGeneration NYCHA plan.”

Van Dyke III is financed under HDC and HPD’s ELLA program. HDC provided $46.670 million in tax-exempt bonds and $11.7 million in corporate reserves, HPD contributed $23.4 million in City Capital. The project benefits from low-income housing tax credits (LIHTC) resulting in a total of $39.243 million in tax credit equity. Brooklyn Borough President provided $800,000 in Reso A funds. Goldman Sachs was the tax-credit investor and Citi Community Capital provided a stand-by letter of credit.

###

About Trinity Financial Inc.:

Trinity Financial has a long and stellar record of successfully developing public housing authority mixed-finance projects. Founded in 1987, Trinity Financial has completed or is currently developing over $3 billion in real estate, including over 9,500 residential units, more than 3,000 of which have been developed as part of large scale public housing redevelopment initiatives. This includes more public housing redevelopment work in the Northeast than any other developer in the country. Trinity’s vision is to revitalize neighborhoods, strengthen commerce and foster opportunities through a collaborative urban spirit.

About The New York City Department of Housing Preservation and Development (HPD):

HPD is the nation’s largest municipal housing preservation and development agency. Its mission is to promote quality housing and diverse, thriving neighborhoods for New Yorkers through loan and development programs for new affordable housing, preservation of the affordability of the existing housing stock, enforcement of housing quality standards, and educational programs for tenants and building owners. HPD is tasked with fulfilling Mayor de Blasio’s Housing New York Plan which was recently expanded and accelerated through Housing New York 2.0 to complete the initial goal of 200,000 homes two years ahead of schedule—by 2022, and achieve an additional 100,000 homes over the following four years, for a total of 300,000 homes by 2026. For full details visit www.nyc.gov/hpd and for regular updates on HPD news and services, connect with us on Facebook, Twitter, and Instagram @NYCHousing.

About The New York City Housing Development Corporation (HDC):

The New York City Housing Development Corporation (HDC) is the nation’s largest municipal Housing Finance Agency and is charged with helping to finance the creation or preservation of affordable housing under Mayor Bill de Blasio’s Housing New York plan. Since 2003, HDC has financed more than 180,000 housing units using over $23.5 billion in bonds and other debt obligations, and provided in excess of $2.9 billion in subsidy. HDC ranks among the nation’s top issuers of mortgage revenue bonds for affordable multi-family housing on Thomson Reuter’s annual list of multi-family bond issuers. In each of the last seven consecutive years, HDC’s annual bond issuance has surpassed $1 billion. For additional information, visit: http://www.nychdc.com.

About the New York City Housing Authority (NYCHA):

NYCHA’s mission is to increase opportunities for low- and moderate-income New Yorkers by providing safe, affordable housing and facilitating access to social and community services. Over 390,000 New Yorkers reside in NYCHA’s 316 public housing developments and PACT/RAD developments formerly managed by NYCHA around the five boroughs. Over 190,000 receive subsidized rental assistance in private homes through the NYCHA-administered Section 8 Leased Housing Program. For more information, visit www.nyc.gov/nycha, and for regular updates on NYCHA news and services, connect with us via www.facebook.com/NYCHA and www.twitter.com/NYCHA.

About Goldman Sachs:

UIG deploys Goldman Sachs’ capital by making investments and loans that benefit urban communities. Through its comprehensive community development platform, UIG is a catalyst in the revitalization of underserved neighborhoods. Since its inception, UIG has committed more than $8 billion, facilitating the creation and preservation of over 36,000 housing units - the majority of which are affordable to low, moderate and middle-income families - as well as over 2,700,000 square feet of community facility space and over 10,400,000 square feet of commercial, retail, and industrial space.

About Citi Community Capital:

Citi Community Capital (CCC) is a premier financial partner with nationally recognized expertise in financing all types of affordable housing and community reinvestment projects. In 2018, CCC originated $6 billion in construction and permanent loans to finance 31,000 units of renovated or new affordable housing. CCC's origination, structuring, asset and risk management staff across the country provides creative financing solutions designed to meet their clients' needs. CCC helps community development financial institutions, real estate developers, national intermediaries and nonprofit organizations achieve their goals through a broad, integrated platform of debt and equity offerings. For more information, please visit: http://www.citicommunitycapital.com./