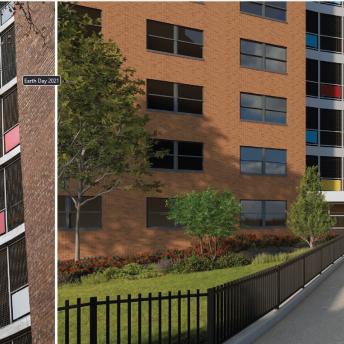

April 22, 2015 -Bronx, New York, – The New York City Department of Housing Preservation and Development (HPD) and New York City Housing Development Corporation (HDC), joined Azimuth Development Group, Best Development Group, the Upper Manhattan Development Corporation and partners to celebrate the ribbon-cutting ceremony for Morris Court Apartments. Morris Court Apartments include two connected six-story mid-rise buildings located at 253 East 142nd Street and 250 East 144th Street in the Mott Haven neighborhood of The Bronx. There are a combined total of 201 affordable apartments in this development that serve low-income families earning up to 60 percent and 80 percent of Area Median Income as well as formerly homeless individuals and families.

“The Morris Court Apartments show how a rezoning paired with strategic investments in affordable housing can serve to safeguard affordability within a neighborhood, while turning underused lots into a resource that will serve the community for decades,” said HPD Commissioner Vicki Been. “In addition to serving low-income families this development also provides permanent housing for formerly homeless New Yorkers, giving them the stability and opportunity they need to get back on their feet. I would like to thank our sister agency HDC and our development partners at Azimuth Development Group, Best Development, JP Morgan Chase, and Raymond James.”

“In meeting our affordable housing goals, the city is committed to reaching a much broader range of New Yorkers and fostering the economic diversity that is the hallmark of a great city,” said Gary Rodney, President of HDC. “Morris Court Apartments is an example of how rezoning can help transform neighborhoods plagued with vacant and under-used sites, and serves as a model for the type of mixed-income, mixed-use development we hope to achieve under Housing New York. This project is providing not just units of affordable housing, but quality homes and a fresh start, not just for the residents, but for the community. On behalf of HDC, I would like to thank all of our remarkable partners for their commitment to making this project a success.”

“Morris Court is a transformative project for The Mott Haven area,” said Guido Subotovsky, President of Azimuth Development Group LLC. “We feel that this development will serve a neighborhood that has been in dire need of quality affordable housing for some time. The demand for housing is growing at an exponential pace, as evidenced by the 35,000 applications we received for our units. It is our hope that Morris Court will serve as a model for future development in the South Bronx.”

“Morris Court Apartments is the result of a vision that New York City government and our local elected officials undertook some 5-6 years ago with the Lower Concourse rezoning,” said Ron Schulman, Principal, Best Development Group LLC. “The rezoning allowed a neighborhood grow and become more vibrant with 201 new apartments, over 30,000 square feet of retail space and parking on site. Our financing agencies at NYC HPD and NYC HDC and our financial partners at JP Morgan Chase and Raymond James Financial helped us bring this project to a successful completion. The result and hard work of all those involved is positive permanent change for the great borough of the Bronx, NY. We thank everyone involved and we are proud that 201 families have a new apartment to call home.”

Morris Court Apartments is the first completed affordable housing development that was made possible by the Lower Concourse Rezoning. On June 30, 2009, the City Council adopted the Lower Concourse Rezoning to allow for housing development. This area has historically been industrial, with a mix of 4 to 12 story loft buildings and lower-rise industrial and automotive uses.

Morris Court Apartments contains approximately 273,077 square-feet of gross building area between its two buildings. The total development area encompasses an entire city block. The 253 East 142nd Street building includes a total of 101 apartments with a unit distribution of 10 studio, 41 one-bedroom, 43 two-bedroom, and six three-bedroom apartments. The 250 East 144th Street building includes a total of 100 apartments with a unit distribution of 21 studio, 27 one-bedroom, 45 two-bedroom, and six three-bedroom apartments.

The overall development also includes a below-grade parking garage containing approximately 185 parking spaces, and approximately 30,202 square-feet of retail space. It is anticipated that a Brightside Daycare and a Dollar Tree storefront will occupy the commercial spaces. Rent generated from the commercial tenants will help to subsidize the affordable apartments.

Apartments in this development have been created to serve low-income and formerly homeless residents. Approximately 179 units are affordable to households earning at or below 60 percent of the Area Median Income (AMI), or an annual income of no more than $34,860 for an individual or $49,800 for a family of four. The remaining 20 units are affordable to households earning at or below 80 percent of AMI, or an annual income of no more than $46,500 for an individual or $66,400 for a family of four. Of the total units in this development, 41 units have been set aside for formerly homeless individuals.

Income levels are calculated annually by the U.S. Department of Housing and Urban Development (HUD). The above incomes are set according to HUD’s 2012 calculations.

The total development cost for Morris Court Apartments is approximately $69.7 million. HDC provided approximately $34.5 million in tax exempt bonds toward construction financing and $22 million in tax exempt bonds toward permanent financing. HDC also provided approximately $13 million from its corporate reserves. HPD provided Low-Income Housing Tax Credits to this project. HPD also provided approximately $8.3 million in 421a Funds. JP Morgan Chase acted as lender to this development and Raymond James acted as tax credit syndicator.

Morris Court Apartments is fully leased. The City of New York requires that city-subsidized apartments be rented through NYC Housing Connect, an Open Lottery System to ensure fair and equitable distribution of housing to income-eligible applicants. The housing lottery for this development closed on April 7, 2014. Marketing of the apartments and the application process for the lottery typically begins when construction is approximately 70 percent complete. For more information regarding the affordable housing lottery process or if you would like to receive an e-mail when HPD updates its available apartment and home website listings for City-subsidized housing in the five boroughs, please visit the ‘Find Housing’ page under the ‘Renter’ tab at www.nyc.gov/hpd. Current housing lotteries are also available at www.nyc.gov/housingconnect. Applicants may submit either a paper application or an electronic application. Duplicate applications will be disqualified.

About the New York City Department of Housing Preservation and Development (HPD):

HPD is the nation’s largest municipal housing preservation and development agency. Its mission is to promote quality housing and viable neighborhoods for New Yorkers through education, outreach, loan and development programs, and enforcement of housing quality standards. HPD is tasked with fulfilling Mayor de Blasio’s Housing New York: A Five-Borough Ten-Year Plan to build and preserve 200,000 affordable units for New Yorkers at the very lowest incomes to those in the middle class. For more information visit www.nyc.gov/hpd and for regular updates on HPD news and services, connect with us via www.facebook.com/nychpd and www.twitter.com/nychousing.

About the New York City Housing Development Corporation (HDC):

HDC is the nation’s largest municipal Housing Finance Agency and is charged with helping to finance the creation or preservation of affordable housing under Mayor Bill de Blasio’s Housing New York plan. Since 2003, HDC has financed more than 120,000 housing units using over $13.7 billion in bonds, and provided in excess of $1.6 billion in subsidy from corporate reserves. HDC has been the #1 issuer in the nation of mortgage revenue bonds for affordable multi-family housing in each of the last three years. In Affordable Housing Finance Magazine’s most recently published annual listing of the nation’s top ten funders of multi-family housing, HDC is the only municipal entity on the list. HDC is also the third largest affordable housing lender in the U.S. after Citi and Wells Fargo, ranking ahead of such industry leaders as Bank of America and Capital One. For additional information, visit: www.nychdc.com.