July 10, 2014 - New York City Department of Housing Preservation and Development (HPD) Commissioner Vicki Been and New York City Housing Development Corporation (HDC) President Gary Rodney announced today that the City financed the creation and preservation of more than 8,700 affordable units during the de Blasio Administration’s first six months. These units represent a direct investment of approximately $250 million by the City of New York. During Fiscal Year 2014 which began on July 1, 2013 and ended on June 30, 2014 more than 13,260 units of affordable housing were financed by the city.

In May of this year, Mayor de Blasio announced Housing New York: A Five-Borough, 10-Year Housing Plan, a $41 billion plan to finance the creation and preservation of 200,000 units of affordable housing. The most ambitious and comprehensive affordable housing plan in the city’s history, its goal is to help address the crisis of affordability in our city by reaching more than half a million New Yorkers ranging from those with very low incomes at the bottom of the economic ladder to those in the middle class who are facing ever-rising rents in their neighborhoods

“We are committed to building and preserving more affordable housing than ever before to confront this affordability crisis. From families living on minimum wage to those in the middle class, New Yorkers are more burdened by the high cost of housing than ever before. That’s why we’re creating new programs, cutting red tape and getting more out of every dollar we invest in housing. In just these first few months, HPD and HDC made a significant down payment on the affordable housing we need to stem this crisis,” said Deputy Mayor for Housing and Economic Development Alicia Glen.

“The incredible HPD and HDC staffs brought amazing energy, dedication and skill to the end of fiscal year closing season,” said HPD Commissioner Been. “The city has worked hard to spur development, encourage preservation, and ensure that we are getting the most affordable housing for the benefits we offer. The result of this work means that 13,260 New York families will have stable, affordable homes and an opportunity to build a better quality of life. Financing more than 8,700 units over the course of six short months is testament to the commitment of our many partners in city government, at the state and in every sector to work with us to realize our Housing New York goals. I thank all of our government partners, non-profit and for-profit developers, community organizations, and lenders and investors who have joined us in striving to make our city more affordable and equitable for all New Yorkers.”

“While the Housing New York plan will be counted in units and dollars, we should not lose sight of the true measure of its success – the people who will call the units their homes and the dollars invested into new opportunities,” said HDC President Rodney. “We are all stakeholders in the future of our city and we all benefit from a more equitable and sustainable New York. I thank the HDC and HPD staff for their thoughtful, determined expertise and professionalism, and our colleagues in State government, and the development, financial, and not-for-profit sectors for their absolutely essential partnership.”

Through the first six months of the year, the Administration has financed more than 8,700 units of new affordable housing. Under Housing New York, the City is committed to ensuring that a higher percentage of units of affordable housing reach the neediest people as well as those in the middle-class who are often underserved by the private market. The City is also committed to ensuring that affordable housing is preserved and created in neighborhoods across the five boroughs in order to respond to the breadth of the City’s affordability crisis.

New Construction

Of the 8,700 affordable units that were financed, roughly 2,600 will be newly constructed. These units are slated to be built on both city-owned and privately owned land across the five boroughs. The projects the Administration helped to finance include a wide range of creative new affordable housing developments on underused private property and on vacant city-owned sites. Using those sites to improve neighborhoods and lower the cost of construction is a key principle of the mayor's plan. Examples of these projects include:

Supportive Housing Development:

CAMBA Gardens II will be a 293-unit supportive, affordable housing development built on an underused lot on Kings County Hospital property in the East Flatbush area of Brooklyn. This project will be developed in collaboration with New York City Health and Hospitals Corporation (HHC), the New York City Department of Homeless Services (DHS), the New York City Department of Health and Mental Hygiene (DHMH), the New York State Housing Finance Agency (HFA), HPD and HDC. CAMBA Housing Ventures, Inc., the community based non-profit developer and social service provider will provide housing and onsite access to comprehensive healthcare services. This development will be made possible through New York City and New York State collaborations through the NY/NY III Agreement and the State’s Medicaid Redesign Team (MRT). Mayor de Blasio emphasized his commitment to encouraging the production of new supportive housing through the use of these programs in Housing New York.

Mixed-Income and Mixed-Use Development:

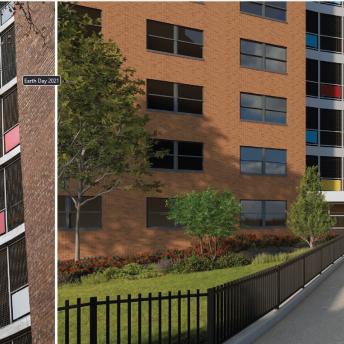

810 River Avenue in the Bronx exemplifies the comprehensive neighborhood approach to housing development. This 17-story, 134-unit building is the first residential building to start construction in the 161st Street/River Avenue Rezoning Area. The mixed-use development offers wide breadth of income diversity to this growing community with apartments that will be targeted to households in need with very low-incomes up to those with moderate-incomes; a range that includes apartments at 40, 60, 90, and 130 percent of Area Median Income (AMI) within the same development. Its more than 27,850 square feet of new retail space brings with it new economic opportunity, and along with its proximity to public transit will help act as a catalyst for future residential development in the rezoned area. The project is a multi-agency collaboration between City and State agencies including HPD, HDC, New York State Homes and Community Renewal (HCR), and the New York State Energy Research and Development Authority (NYSERDA). The development team will be led by M. Melnick & Co., Inc.

Preservation:

HPD and HDC also preserved approximately 6,140 units of housing as affordable. Some of these buildings were in affordability programs that were nearing the end of their regulatory agreements. In order to preserve the affordability of these properties, the City was able to offer low-interest financing to help qualified developers acquire and rehabilitate the properties. By helping to refinance these properties, the City prevented them from going to the open market and ensured long-term affordability for the tenants. Other properties were privately owned and in financial and/or physical distress, oftentimes threatening the wellbeing of the tenants. Examples of these projects include:

Mitchell-Lama Preservation:

Cadman Towers is a 422-unit City-supervised Mitchell-Lama co-op located in Brooklyn Heights. HDC refinanced Cadman Towers’ outstanding debt, which secured an additional 20 years of affordability in this increasingly high cost neighborhood. The refinancing also provided Cadman Towers with additional funds for building repairs. As part of its Mitchell Lama Restructuring Program, HDC blended a senior and subordinate loan with a $5 million grant to provide the low rate financing critical to preserving this development’s affordability. Preserving the affordability of Mitchell Lama developments like Cadman Towers is an essential component of the Mayor’s plan.

Distressed/Overleveraged Property Preservation:

A central goal of the Housing New York plan is to preserve affordable housing that was previously government assisted. 1380 University Avenue, constructed in 1968 through the Mitchell-Lama program, is a 17-story, 139-unit property in the Bronx. The previous owners opted out of the Mitchell-Lama program in 1998, and managed to artificially increase the property’s value by illegally subdividing units and refinancing. HPD and HDC recognized an opportunity to bring the building back into affordability by working with responsible new owners, Workforce Housing Advisors and the Urban Homesteading Assistance Board (UHAB), to finance the acquisition and rehabilitation of 1380 University Avenue. In addition to paying for much-needed repair work, the financing will ensure rents in 118 of the units will be affordable to families earning no more than 60 percent of the Area Median Income (AMI). The remaining units will be affordable to households earning up to 90% AMI. Keeping existing units affordable and protecting tenants in overleveraged and poorly maintained buildings are key commitments of the Mayor’s housing plan.

The Mayor has already demonstrated his commitment to providing the critical resources that will be needed to meet the goals of the Housing New York plan. Earlier this year he doubled the allocation of mayoral capital funding in HPD’s five-year capital plan to $2.5 billion by Fiscal Year 2018 to ensure that the agency will be able to increase its investment in the creation and preservation of affordable housing in all five boroughs.

Additionally, the Mayor has provided $2 million in the recent budget for HPD that will assist in the hiring of more than 60 new staff to support tenants and boost capacity to develop affordable housing, as well as an additional $1 million to increase staff in the Alternative Enforcement Program (AEP) which annually targets the city’s most distressed residential properties for remediation.

Going Forward

The Administration is collaborating with the City Council, the State and Federal Government, other public entities, and the private and not-for-profit sectors on a range of initiatives to increase and make better use of financing and incentives; to lower construction costs and cut red tape; and to develop strategies that will enable a wider share of New Yorkers and neighborhoods to benefit from affordable housing.

The Department of City Planning (DCP), in partnership with HPD and HDC, is commencing the planning study and financial analysis necessary to move forward with the mandatory Inclusionary Housing program announced in the Housing New York plan. The NYC Economic Development Corporation is spearheading an interagency effort to identify vacant and underused publicly owned land that the City will evaluate for development opportunities and for strategic neighborhood investments.

On the legislative front, HPD worked successfully with its partners in the state legislature to pass a bill to authorize the City to launch an initiative to ensure that more minority and women-owned businesses participate in affordable housing programs. The State Legislature also voted to increase the Disability Rent Increase Exemption (DRIE) eligibility criteria to match the newly increased Senior Citizen Rent Increase Exemption eligibility.

About The New York City Department of Housing Preservation and Development (HPD):

HPD is the nation’s largest municipal housing preservation and development agency. Its mission is to promote quality housing and viable neighborhoods for New Yorkers through education, outreach, loan and development programs, and enforcement of housing quality standards. HPD is tasked with fulfilling Mayor de Blasio’s Housing New York: A Five-Borough Ten-Year Plan to build and preserve 200,000 affordable units for New Yorkers at the very lowest incomes to those in the middle class. For more information visit www.nyc.gov/hpd and for regular updates on HPD news and services, connect with us via www.facebook.com/nychpd and www.twitter.com/nychousing.

About the New York City Housing Development Corporation (HDC):

Since 2000, HDC has issued roughly 10% of all the multi-family housing revenue bonds in the U.S. and since 2003 HDC has raised more than $6.7 billion in financing for affordable housing developments, including providing in excess of $1 billion in subsidy from corporate reserves. In Affordable Housing Finance magazine’s annual listing of the nation’s top ten funders of multifamily housing, HDC is the only municipal entity on the list. In 2013, HDC was the third largest affordable housing lender in the U.S. after Citi and Wells Fargo, beating out Bank of America, JPMorgan Chase and Capital One. Since 2003, HDC has partially financed the creation or preservation of nearly than 74,000 affordable units. Multifamily buildings financed by HDC contain more than 1.7 million square feet of commercial space. For additional information, visit: www.nychdc.com.