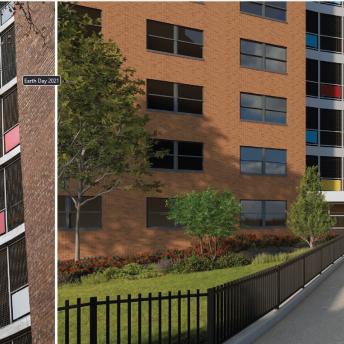

Bronx, N.Y. – The New York City Housing Development Corporation (HDC) Senior Vice President of Development Anthony Richardson and the New York City Department of Housing Preservation and Development (HPD) Assistant Commissioner Susan Kensky joined High Hawk LLC and project partners to break ground on the High Hawk Apartments development in the Crotona Park East neighborhood of the Bronx. The new 105,896 square-foot, eight-story development will be located at 1776 Boston Road and will provide 72 new affordable apartments for a diversity of income levels.

The construction of High Hawk Apartments will be financed under Mayor Bill de Blasio’s Housing New York: A Five-Borough, 10-Year Housing Plan, to finance the creation and preservation of 200,000 units of affordable housing. The most comprehensive affordable housing plan in the city’s history, its goal is to help address the crisis of affordability in our city by reaching more than half a million New Yorkers ranging from those with very low incomes to those in the middle class who face ever-rising rents in their neighborhoods.

“The people who live in Crotona Park East have been waiting to see this site redeveloped for more than two decades,” said HDC President Gary Rodney. “And I am very pleased that now we have the right mix of developer, non-profit sponsor and financing to make this plan work. Creating mixed-use and mixed-income affordable developments that promote economic diversity and neighborhood growth is a central goal of the Mayor’s Housing New York plan. I thank my team at HDC, my colleagues at HPD, developers Thomas Webler and Peter Bourbeau, Tolentine-Zeiser Community Life Center, Inc., the Federal Home Loan Bank of Atlanta and Capital One for the hard work and due diligence that has brought us to this groundbreaking.”

“High Hawk is exactly the type of mixed-income development envisioned by Mayor de Blasio’s Housing New York plan to bring new opportunity and income diversity to this neighborhood,” said HPD Commissioner Vicki Been. “We have pledged to build housing that is affordable to people who make a range of incomes, including those who are middle-income. This is essential to promote long-term community revitalization. I am also gratified to welcome a new community partner to the roster: Tolentine-Zeiser Community Life Center which provides services that range from programs dealing with affordable child care, homelessness, HIV and AIDS, and immigration. Thanks to our partners at HDC, my team at HPD, the developers, and the Federal Home Loan Bank of Atlanta and Capital One for making this project possible.”

When complete, High Hawk Apartments will contain one studio apartment, 16 one-bedroom apartments, 48 two-bedroom apartments (including one set aside for the superintendent), and eight three-bedroom apartments, as well as three tenant recreation areas and bicycle storage. Additionally, 8,466-square-feet will be dedicated to commercial uses, 3,171-square-feet will be reserved for a ground floor community facility on Hoe Avenue, and 12,152-square-feet will be reserved for a below-grade parking garage.

High Hawk Apartments will be a mixed-income development that aims to increase income diversity by offering apartments that will be affordable to both low- and moderate-income New Yorkers. 18 units will be restricted to households earning up to 60% of AMI ($51,540 for a family of four), and the remainder 54 units will be affordable households earning up to 100% AMI ($ 83,900 for a family of four). AMI levels are calculated annually by the U.S. Department of Housing and Urban Development (HUD). Income levels for this development are set by HUD’s 2014 calculations.

“The High Hawk affordable housing project came together due to the generous financing from all of our development partners,” said High Hawk LLC President Peter Bourbeau. “These 72 units of mixed- income units and 8,000-square-feet of new retail space has been 10 years in the making but it will be worth the wait. We gladly welcome this new development to the neighborhood.”

The total development cost for High Hawk Apartments is approximately $23.7 million. HDC will finance the construction phase with $8,885,000 in recycled tax-exempt bonds that will be enhanced during the construction period by a letter of credit from Capital One. Additional sources include an HDC Second Mortgage of $6,205,000, HPD subsidy of $5,475,000 in City Capital funds.

The New York City Department of Housing Preservation and Development (HPD):

HPD is the nation’s largest municipal housing preservation and development agency. Its mission is to promote quality housing and viable neighborhoods for New Yorkers through education, outreach, loan and development programs, and enforcement of housing quality standards. HPD is tasked with fulfilling Mayor de Blasio’s Housing New York: A Five-Borough Ten-Year Plan to build and preserve 200,000 affordable units for New Yorkers at the very lowest incomes to those in the middle class. For more information visit www.nyc.gov/hpd and for regular updates on HPD news and services, connect with us via www.facebook.com/nychpd andwww.twitter.com/nychousing.

About the New York City Housing Development Corporation (HDC):

HDC is the nation’s largest municipal Housing Finance Agency and is charged with helping to finance the creation or preservation of affordable housing under Mayor Bill de Blasio’s Housing New York plan. Since 2000, HDC has issued roughly 10% of all the multi-family housing revenue bonds in the U.S. and since 2003 HDC has financed 122,513 housing units using over $13.7 billion in bonds, and provided in excess of $1.5 billion in subsidy from corporate reserves. HDC is the #1 issuer in the nation of mortgage revenue bonds for affordable multi-family housing in eight of the last ten years (2013, 2012, 2010, 2009, 2008, 2006, 2005, & 2004). HDC bonds are rated Aa2/AA+ by Moody's and S&P. In Affordable Housing Finance magazine’s annual listing of the nation’s top ten funders of multi-family housing, HDC is the only municipal entity on the list. In 2013, HDC was the third largest affordable housing lender in the U.S. after Citi and Wells Fargo, beating out Bank of America, JPMorgan Chase and Capital One. Multi-family buildings financed by HDC contain more than 1.7 million square feet of commercial space. For additional information, visit: www.nychdc.com.