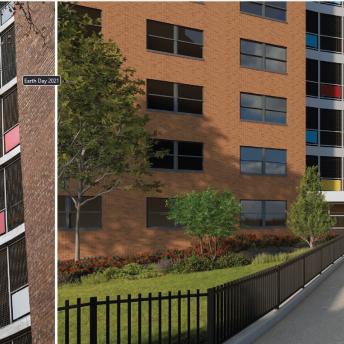

East Harlem, New York – City and State officials joined Hope Community Inc., Monadnock Development LLC, Notias Construction, Inc., Raymond James Tax Credit Funds, Wells Fargo Bank, tenants and partners to announce the construction kick-off for the Hope East of Fifth re-syndication of 506 affordable housing apartments – including 102 units for formerly homeless residents across 39 buildings in the East Harlem neighborhood of Manhattan.

This Year 15 re-syndication will provide for major capital improvements that include the renovation of apartment kitchens and bathrooms, new roofs, new windows, intercom and camera systems, new entrances, energy efficient heating systems, exterior masonry repairs, and ADA compliance upgrades in selected apartments. At the time of its construction closing, Hope East of Fifth was one of the largest resyndication projects of its kind. Construction work is currently underway and is projected to be completed by the end of next year.

“Preservation is a key strategy of all our work in neighborhoods, and a cornerstone of the East Harlem Housing Plan,” said HPD Commissioner Maria Torres- Springer. “Through projects like Hope East of Fifth, the City is using all its tools to safeguard the affordability of East Harlem, while working on multiple fronts to promote housing and economic opportunities for the community. Thanks to the leadership of Speaker Mark-Viverito and our partnership with Hope Community Inc., Monadnock, Notias Construction, HDC, and so many others, more than 500 New Yorkers will breathe easier, knowing the quality and stability of their home is secure.”

“The rich history and culture of the East Harlem neighborhood reflects the commitment of residents who have rooted their lives in the community for generations,” said HDC President Eric Enderlin. “Hope East of Fifth will keep approximately 1,000 local residents in their homes and bring much-needed improvements, while shoring up the affordability of the neighborhood. Thanks to our many dedicated partners at HPD, Hope Community, Notias Construction, Monadnock Development, Kalel Holdings, Raymond James, Wells Fargo, the Federal Home Loan Bank, and all our elected officials for their ongoing support.”

City Planning Commission Chair Marisa Lago said, “Protecting the residents who live in East Harlem today must be a key deliverable of any strategy, as this will help ensure that the neighborhood remains affordable, vibrant and livable. I am delighted that the affordability of more than 500 units will be locked in. By improving the condition of 39 East Harlem buildings, not only will their current residents benefit; their long term viability will also be enhanced. These City actions complement the goals of the proposed East Harlem zoning changes, which are currently in public review.”

The average apartment rent at the time of closing at Hope East of Fifth is affordable to residents earning up to $38,100 for an individual or $54,360 for a family of four. Of the 506 units, 20% will now be set aside for formerly homeless individuals and families. The building is currently 100% occupied with 75 units dedicated to formerly homeless households. Apartments will serve formerly homeless households as vacancies arise until the increased set aside of 102 units for formerly homeless households is fulfilled. This resyndication project serves to protect the affordability of and provide much needed repairs to the homes of nearly 1,000 New Yorkers.

“The preservation of affordable housing has been a priority under my Speakership, and I am excited that the construction kickoff of Hope East of Fifth will preserve existing affordable units in El Barrio/East Harlem. With the costs of living continuing to rise, the last thing families need to worry about is higher rents – and these affordable units will go a long way towards alleviating that burden,” said New York City Council Speaker Melissa Mark-Viverito. “I look forward to continuing to work with community partners like Hope Community to address the housing affordability crisis in New York City.”

“With 506 apartments preserved and 102 prioritized for formerly homeless New Yorkers, this is the kind of project I want to see more of,” said Manhattan Borough President Gale A. Brewer. “We talk a lot about building new affordable housing, but preserving existing units is just as important, and projects like this one are a welcome sight.”

“In an area of New York City where our low-income residents are desperately fighting to maintain a dwindling housing stock, Hope Community, HPD, and HDC are taking critical steps to preserve over 500 affordable units within East Harlem. I am encouraged by the partnership's steadfast commitment to enhancing the quality of life and living conditions of low-income people across the community,” said Assembly Member Robert J. Rodriguez.

The project is comprised of 39 occupied buildings and approximately 11,873 square feet of commercial space. The 506 units consist of 131 studio apartments, 146 one-bedroom apartments, 185 are two-bedroom apartments, 42 three-bedroom units, and 2 four-bedroom apartments.

“Building on our mission of enriching the lives of the people who live and work in East Harlem, Hope East of Fifth addresses a critical need for maintaining quality affordable housing for our low-to-moderate income residents, as well as formerly homeless individuals and their families,” remarked Walter Roberts, Executive Director of Hope Community, Inc. – one of the project development partners. “By investing in the much-needed repairs to these buildings, we are enhancing the residents’ lives, as well as strengthening these neighborhoods.”

“We are proud to partner on such a significant project”, remarked Nick Lembo, President of Monadnock Development. “This unique revitalization was only made possible through our joint venture with Hope Community and Notias Construction, and with the support of our financing partners at HDC and HPD. Extending the affordability of these apartments for another 30 years will create lasting impact for generations and will enhance the community’s ability to grow and flourish.”

“Renovation of these 506 units will create healthy and quality living conditions for an estimated 1,000 East Harlem residents. Our goal at Notias is to enrich the lives of every single resident impacted by our work; we are proud to serve the Hope East of Fifth residents, and to be part of such a dynamic partnership with Hope Community and Monadnock,” said Pericles Notias, President of Notias Construction, Inc.

“In a community where the indigenous demographic is facing the challenge of finding an affordable place to live, Hope East of Fifth presented the perfect preservation opportunity where residents would benefit from apartment and building upgrades without there being any major impact to their existing rent levels. This would not have been made possible without the investment from our public partners HDC and HPD, and our joint venture development partnership with Hope Community and Monadnock,” stated Pierre Downing, Manager of Real Estate Development at Notias Construction, Inc.

HDC is providing $63 million in tax-exempt bond financing towards the construction of this project. At project completion, permanent financing will consist of a $20.7 million loan from HDC, a $4.46 million in new City Capital (HPD Year 15) subsidy, $43.1 million in low-income housing tax credit equity, as well as $27.75 million in re-cast and extended existing HPD subsidy or low-interest debt. Raymond James is the tax credit syndicator and Wells Fargo provided credit enhancement for this milestone preservation project.

“Preservation of our precious affordable housing stock is crucial to the health of the City and its residents. In our role as provider of the credit enhancement, Wells Fargo worked closely with the development team and our government partners at HPD and HDC to deliver a financial solution that will benefit both the current residents and those seeking quality affordable housing in the future”, stated Duane Mutti, SVP of Wells Fargo Community Lending & Investment.

Noel Henderson-James, Assoc. Director of Acquisitions, Raymond James Financial, Inc. said, “Raymond James Tax Credit Funds, the industry leader in facilitating investment in affordable housing developments across the country, is pleased and excited to contribute to the preservation of more than 500 apartments for low-income families in the East Harlem neighborhood. Partnering again with Hope Communities, Inc., and for the first time with Notias Construction and Monadnock Development, RJTCF raised more than $40MM in investor equity for this project, which will provide a long-term affordability solution for an area of New York City that has seen dramatically increasing rents. We are also pleased to once again work with HPD and HDC to implement their City’s plan to create and preserve 200,000 affordable apartments across the city. While RJTCF invested more than $1 billion in affordable housing developments nationwide in 2016 none of our investments will have a greater community impact than Hope East of Fifth.”

###

The New York City Department of Housing Preservation and Development (HPD):

The New York City Department of Housing Preservation and Development (HPD) is the nation’s largest municipal housing preservation and development agency. Its mission is to promote quality housing and diverse, thriving neighborhoods for New Yorkers through loan and development programs for new affordable housing, preservation of the affordability of the existing housing stock, enforcement of housing quality standards, and educational programs for tenants and building owners. HPD is tasked with fulfilling Mayor de Blasio’s Housing New York: A Five-Borough Ten-Year Plan to create and preserve 200,000 affordable units for New Yorkers at the very lowest incomes to those in the middle class. For more information visit www.nyc.gov/hpd and for regular updates on HPD news and services, connect with us via www.facebook.com/nychpd and www.twitter.com/nychousing.

New York City Housing Development Corporation (HDC):

HDC is the nation’s largest municipal Housing Finance Agency and is charged with helping to finance the creation or preservation of affordable housing under Mayor Bill de Blasio’s Housing New York plan. Since 2003, HDC has financed more than 120,000 housing units using over $13.7 billion in bonds, and provided in excess of $1.6 billion in subsidy from corporate reserves. HDC ranks among the nation’s top issuers of mortgage revenue bonds for affordable multi-family housing on Thomson Reuter’s annual list of multi-family bond issuers. In each of the last four consecutive years, HDC’s annual bond issuance has surpassed $1 billion. For additional information, visit: http://www.nychdc.com

Hope Community Inc.:

Hope Community, Inc. is a community-based not-for-profit affordable housing organization. Founded in 1968, the organization also enriches the lives of the people who live and work in East Harlem and surrounding neighborhoods through cultural arts, economic development, and social service alliances. Hope seeks to rebuild the physical infrastructure of East Harlem by creating attractive, high-quality affordable rental and owner-occupied housing. Hope seeks to strengthen the neighborhood's social fabric by assisting in the growth and success of local businesses, by assisting residents to enhance their lives and incomes, and by sponsoring community programs. For additional information, visit: http://www.hopeci.org

Monadnock Development:

Monadnock Development is a leader in the creation of affordable and market-rate housing in New York. We serve a wide variety of New Yorkers by taking on complex projects that improve their neighborhoods. We specialize in sustainable low-income housing, middle-income rentals and home-ownership, and market-rate rentals and condominiums. Combining development, construction, financial, and architectural expertise, our team has created thousands of units across the City. These include New York's first micro unit building in My Micro NY, entire new neighborhoods in Nehemiah Spring Creek, and New York's largest middle-income development in decades in Hunter's Point South. For additional information, visit: http://www.monadnockdevelopment.com

Notias Construction, Inc.:

Established in 1991, Notias Construction, Inc. is one of the premier occupied multifamily rehabilitation and new construction specialists in the New York metropolitan area. Over the past 26 years, Notias has built and rehabilitated over 5,000 units of housing, including mid/hi-rise affordable Low Income Housing Tax Credit assisted housing; US. Dept. of HUD-assisted multi-family and senior housing; and market-rate developments totaling over a quarter of a billion dollars in construction costs.

Raymond James Financial, Inc.:

Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has 7,200 financial advisors serving approximately 3 million client accounts in more than 2,900 locations throughout the United States, Canada and overseas. Total client assets are $643 billion. Public since 1983, the firm has been listed on the New York Stock Exchange since 1986 under the symbol RJF. Additional information is available at www.raymondjames.com

Wells Fargo & Company:

Wells Fargo & Company: (NYSE: WFC) is a diversified, community-based financial services company with $2.0 trillion in assets. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through more than 8,500 locations, 13,000 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 42 countries and territories to support customers who conduct business in the global economy. With approximately 273,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 27 on Fortune’s 2016 rankings of America’s largest corporations. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. News, insights and perspectives from Wells Fargo are also available at Wells Fargo Stories.